On Jan. 1, 2026, the minimum wage will increase in unincorporated King County. The minimum wage is the lowest hourly wage an organization can pay an employee. It will increase from $20.29 an hour to $20.82 an hour, with exceptions for smaller businesses. The increase impacts employees and employers.

Unincorporated King County is a wide and diverse area with a variety of workers and employers. To address this, the King County Council proposed a phase-in period for smaller employers based on the number of employees and the gross revenue to get into compliance.

(See above chart for full structure)

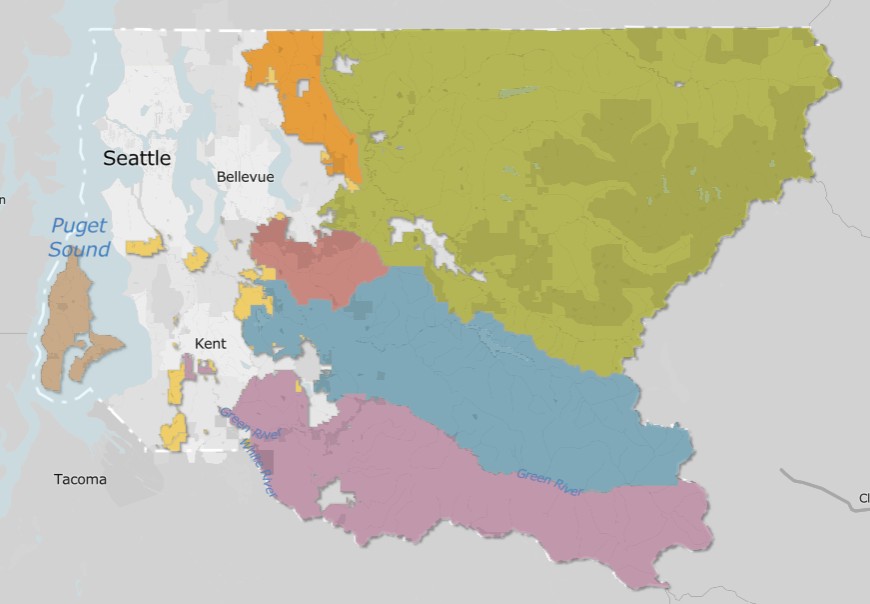

To determine if and how the increase affects you or your business, start here to determine if your business is in unincorporated King County (UKC) or if your workers work in unincorporated King County. Type your address in the search bar, and the map will indicate whether the business/work is located in any of the unincorporated areas.

In the map above, all colored areas are unincorporated King County. This rule applies to all colored areas.

If the business or work is located in King County, refer back to the chart above to see how it is affected by this new ordinance.

History

The King County Council passed a measure in May 2024 with the intent of providing a living wage in an increasingly expensive area and to keep up with other cities in King County that have already raised the minimum wage. Tukwila, for example, raised the minimum wage to $20.29 in January 2023. Seattle raised the minimum wage to $18.69 that same year.

The Washington State minimum wage is $16.66, and it will increase to $17.13 in 2026.

Here are some commonly asked questions from the community:

Who is covered by this ordinance?

Any employee performing work within unincorporated King County should be paid the new minimum wage or higher, regardless of where the employer is located. For example, if the company is based in Oregon and has employees in UKC, the employees performing work in UKC will be paid the new minimum wage.

Are there exceptions for family or young teenagers, or housing or education allowances?

The ordinance does not provide exceptions for family and young teenagers and does not allow for housing and education allowances.

Are there exceptions for small businesses?

Small business exceptions are defined above.